InvITs in India – A Complete Beginner-to-Advanced Guide

What are InvITs?

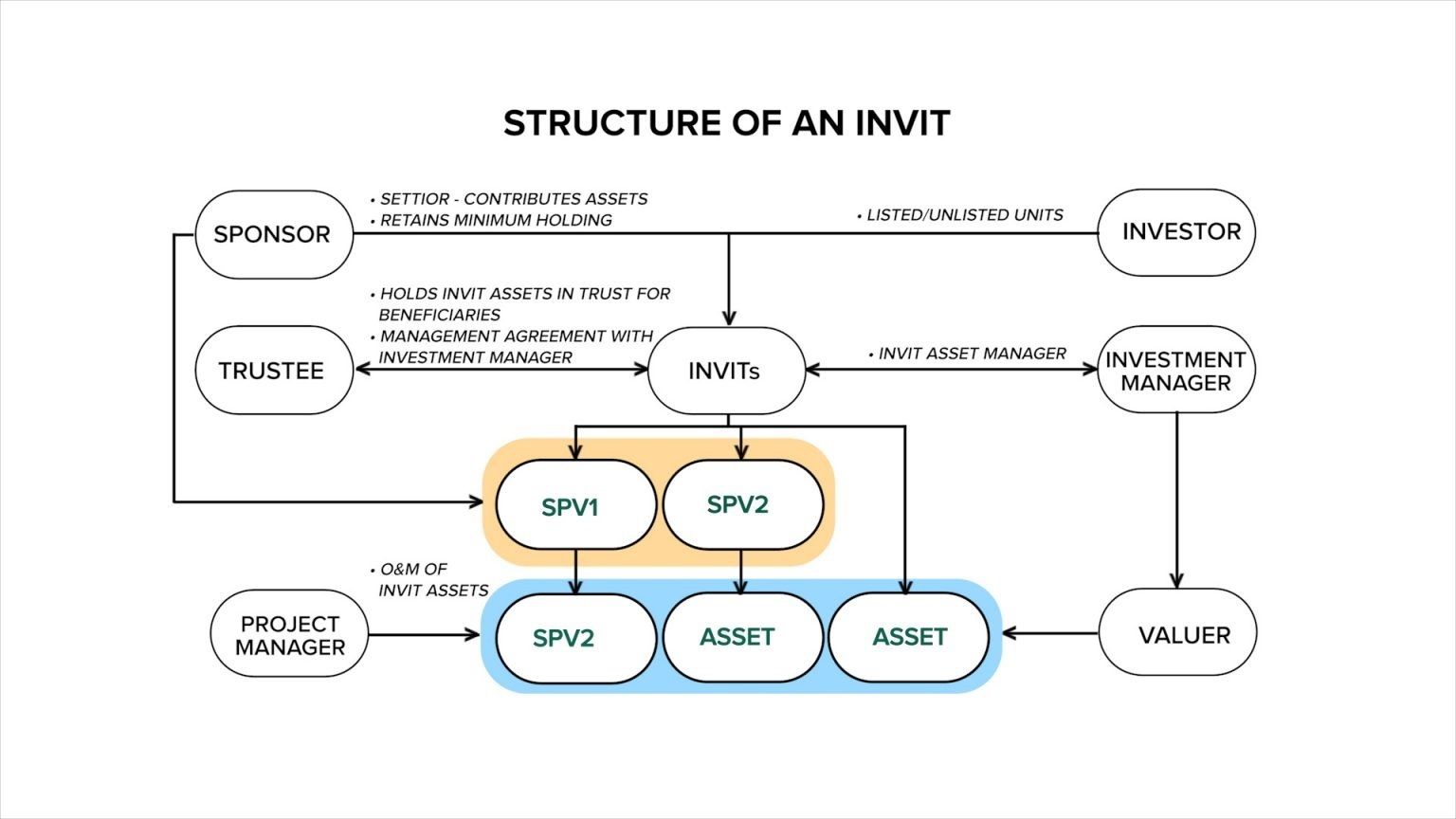

Infrastructure Investment Trusts (InvITs) are investment vehicles introduced by SEBI to allow individuals to invest in large infrastructure assets such as roads, power transmission lines, pipelines, telecom towers, and renewable energy projects.

They work similarly to mutual funds but invest specifically in revenue-generating infrastructure projects.

👉 Simply put: InvITs let you earn regular income from India’s infrastructure growth without owning the asset directly.

Why Were InvITs Introduced in India?

To unlock capital stuck in long-term infrastructure projects

To help developers reduce debt

To give retail investors access to infrastructure income

To fund India’s massive infrastructure expansion (roads, power, green energy)

How InvITs Work (Simple Flow)

Infrastructure asset (highway, power line, etc.) generates revenue

Revenue flows to the InvIT

After expenses, most income is distributed to investors

Investors receive quarterly or half-yearly payouts

By regulation, at least 90% of cash flows must be distributed to unit holders.

Types of InvITs in India

1. Publicly Listed InvITs

Traded on National Stock Exchange of India (NSE) and BSE Limited

Available to retail investors

Transparent pricing and disclosures

Examples:

IRB InvIT Fund

PowerGrid InvIT

IndiGrid InvIT

✅ Best for individual investors

2. Private / Unlisted InvITs

Not listed on stock exchanges

High minimum investment (₹1 crore+)

Mainly for institutions and HNIs

Limited liquidity

❌ Not suitable for retail investors

3. Based on Asset Ownership Structure

a) Equity-based InvITs

Income from tolls, tariffs, or usage fees

Cash flows may vary with economic activity

Higher growth potential

b) Hybrid InvITs

Combination of equity + debt

More stable income with moderate growth

How Can You Invest in InvITs in India?

Method 1: Through Stock Market (Most Common)

Open a Demat & Trading Account

Search for listed InvITs on NSE/BSE

Buy units just like shares

Receive income directly in your bank account

💰 Minimum investment: ~₹10,000–₹15,000

Method 2: During IPO of an InvIT

Subscribe when an InvIT launches its IPO

Similar process to equity IPOs

Units later get listed on exchanges

Method 3: Through Mutual Funds / ETFs

Some debt or hybrid funds may have exposure to InvITs

Lower direct control but easier diversification

Returns from InvITs

Returns come from:

Interest income

Dividend income

Repayment of capital

📊 Typical annual yield: 8%–12% (can vary)

Returns are more income-oriented than growth-oriented.

Taxation of InvITs (Important)

Income Type | Tax Treatment |

|---|---|

Interest | Taxed as per slab |

Dividend | Taxed as per slab |

Capital repayment | Mostly tax-free |

Capital gains | Like equity (short/long term rules) |

📌 Taxation can be complex → always check payout breakup.

Advantages of InvITs

Regular cash flow

Lower volatility than stocks

Exposure to essential infrastructure

Professional management

Regulated by SEBI

Risks You Should Know

Interest rate risk

Traffic / usage risk (for toll roads)

Regulatory & policy risk

Limited capital appreciation

Liquidity risk during market stress

Who Should Invest in InvITs?

✔ Investors seeking steady income

✔ Retirees or conservative investors

✔ Portfolio diversification seekers

✔ Long-term investors (5–10 years)

❌ Not ideal for short-term traders or high-growth seekers

InvITs vs REITs (Quick Comparison)

Feature | InvIT | REIT |

|---|---|---|

Asset Type | Infrastructure | Real Estate |

Income | Tolls, tariffs | Rent |

Risk | Moderate | Low–Moderate |

Growth | Limited | Moderate |

Final Takeaway

InvITs are a powerful but underutilized investment option in India. They sit between fixed income and equity, offering stable returns with moderate risk, backed by India’s long-term infrastructure story.

If used wisely, InvITs can be an excellent income-generating pillar in your investment portfolio.